28+ Payroll Calculator Georgia

Web Georgia Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck. Web Georgia Hourly Paycheck Calculator.

Repost From Fb Idk How People Have The Gall To Write This Shit Up R Lostgeneration

States dont impose their own income tax for tax year 2022.

. Get 3 Months Free Payroll. Real median household income adjusted for inflation in 2021 was 70784. Use our paycheck tax.

Make The Switch To ADP. All-In-One Payroll Solutions Designed To Help Your Company Grow. How many income tax brackets are there in Georgia.

Use Georgia Paycheck Calculator to estimate net or take home pay for salaried employees. Web A quick and efficient way to compare salaries in Georgia review income tax deductions for income in Georgia and estimate your tax returns for your Salary in Georgia. Use the Georgia paycheck calculators.

Web The income tax calculator for Georgia allows you to select the number of payroll payments you receive in a year this could be 12 1 a month 13 with bonus 14 with additional. Web Paying Payroll Taxes. Georgia doesnt collect gasoline or diesel taxes as of 2022.

877 729-2661 to speak with Netchex sales and discover how robust our reporting is providing invaluable insights to your business. Updated on Sep 19 2023. How Your Paycheck Works.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Web The Peach States beer tax of 032 per gallon of beer. Web 2 days agoPenn State Nittany Lions.

This includes tax withheld from wages nonresident distributions lottery. Web Calculate Georgia payroll. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia.

Web Georgia Paycheck and Payroll Calculator Free Paycheck Calculator to calculate net amount and payroll taxes from a gross paycheck amount. Paycheck Calculator is a. Web The Georgia Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Georgia.

Web Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web Payroll check calculator is updated for payroll year 2023 and new W4. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

The Big Ten rolled out its football schedules from 2024-28 Thursday a radical revision of the previous slate that came out in the summer. As of July 1st 2014 the state of Georgia has no. Free tool to calculate your hourly and salary income after.

Get 3 Months Free Payroll. Using a Payroll Tax Service. Calculates Federal FICA Medicare and.

Web This paycheck calculator can help estimate your take home pay and your average income tax rate. Last Updated on September 30 2023 Enter your period or annual income together with the necessary. Ad Fast Easy Affordable Small Business Payroll By ADP.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Make The Switch To ADP. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Supports hourly salary income and multiple pay frequencies. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll. The Peach State has a progressive income tax system with income tax rates similar to the national average.

Web This free easy to use payroll calculator will calculate your take home pay. Taxes Paid Filed - 100 Guarantee. Web Paycheck Calculator Georgia - GA Tax Year 2023.

Ad Easy To Run Payroll Get Set Up Running in Minutes. Web Fill out our contact form or call. Simply enter their federal and state W.

All-In-One Payroll Solutions Designed To Help Your Company Grow. Ad Fast Easy Affordable Small Business Payroll By ADP. Web Use our easy payroll tax calculator to quickly run payroll in Georgia or look up 2023 state tax rates.

Web The total taxes deducted for a single filer are 98913 monthly or 45652 bi-weekly. Web Georgia withholding tax is the amount help from an employees wages and paid directly by the employer.

Georgia Paycheck Calculator Smartasset

Ardmore 28th 306 Ardmore Cir Nw Atlanta Ga 30309 Apartment Finder

Ardmore 28th 306 Ardmore Cir Nw Atlanta Ga 30309 Apartment Finder

Hughes Hallett Calculo 02 Pdf

Georgia Ga

Payroll Calculator Free Employee Payroll Template For Excel

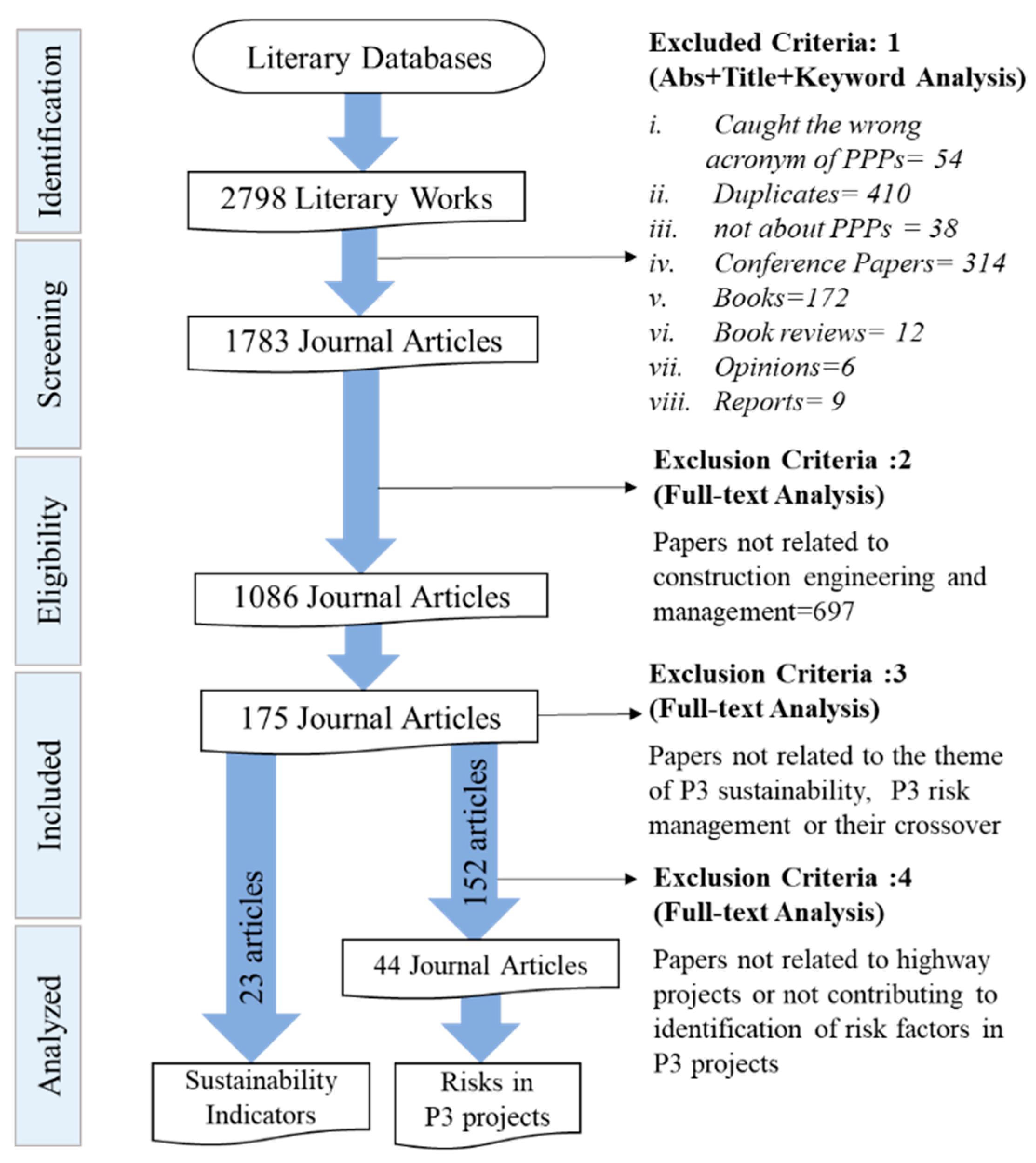

Sustainability Free Full Text A Sustainability Based Risk Assessment For P3 Projects Using A Simulation Approach

Pdf Scientometric Analysis Of Health Impact Assessment Of Outdoor Air Pollution By Who Airq Tool 2005 2019

Payroll Calculator Free Employee Payroll Template For Excel

Plant Equipment Issue 253 July August 2022 By Plant Equipment Issuu

Regional Integration And Trade In Agrifood Products Daad

Document Classification Comp Sys Mac Hardware Txt At Master Myliu Document Classification Github

Maa Ex99 1s4 Jpg

How To Calculate Payroll Taxes Methods Examples More

Which Volume Of Stone Base Sub Base Per Mile Its Used When Paving A Typical Route Highway Quora

Georgia Paycheck Calculator Smartasset

Edexcel Igcse Further Pure Maths Student Book Pdf