38+ reasons underwriters reject mortgages

Web Why would an underwriter deny a loan. Web Common reasons for why mortgages are declined include.

How To Avoid Mortgage Loan Denial By Underwriters

A mortgage is an agreement between the borrower and a lender and as with any loan there is a risk to the lender for.

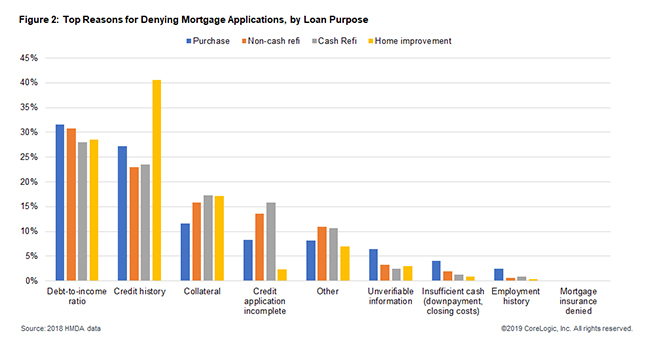

. Web FHA loans can get rejected in the underwriting stage for various reasons. Lenders want to see that you can be trusted. Web These were the top six reasons for mortgage denials in 2020 according to a report by the National Community Reinvestment Coalition NCRC.

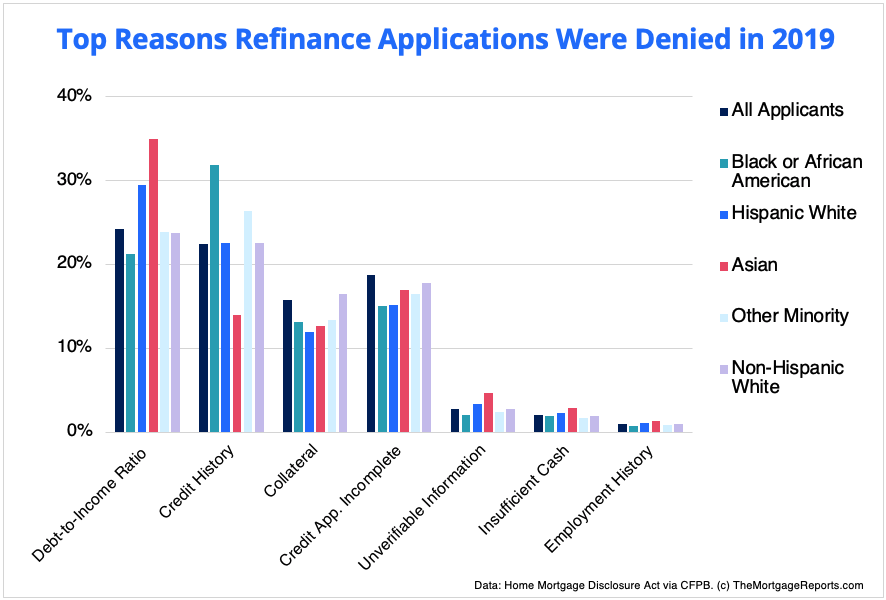

If a mortgage underwriter has declined you due to proof of income then you could try and. Your credit score is something lenders look at very. Your credit history is proof to lenders that you can keep up with loans and pay your bills on time.

Web An underwriter will approve or reject your mortgage loan application based on your credit history employment history assets debts and other factors. You have too much. It might be that the borrowers credit score is too low the debt-to-income ratio is too high or the property.

Bad credit history Low credit score Not enough income Little evidence of income recently self-employed. High Levels of debt A lender will review each mortgage applicants credit file during the underwriting process. Web First well explore a range of reasons why lenders and underwriters reject mortgages.

As part of the mortgage application process your lender will conduct their own valuation of the property you are. Web Having a bad credit history doesnt automatically mean lenders will reject your application but it can make things trickier. Web If major unresolvable problems are found during underwriting the underwriter will reject the loan application or pass along his recommendation that it should be rejected with.

Web Why do underwriters decline mortgage applications. Web Why you were declined by a mortgage underwriter Proof of income. Web Mortgage application declined by underwriter after valuation.

While you can take steps to get approved for a mortgage with bad. Web Why do underwriters decline mortgage applications. Its all about whether that.

There can be many different reasons a loan is not approved ranging from not being able to show enough income to.

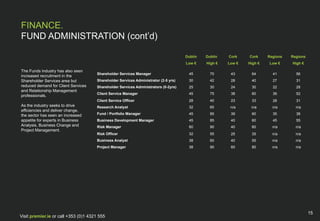

Salary Guide 2010

How Often Does An Underwriter Deny A Loan Supermoney

Mortgage Loan Denied In Underwriting Here S What To Do

![]()

19 Reasons Your Mortgage Loan Could Get Rejected Gobankingrates

What Are The Reasons For Last Minute Mortgage Denial Youtube

The Top Two Reasons Mortgage Applications Were Denied In 2018 And How To Avoid Them Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Del Mar Times 4 25 13 By Utcp Issuu

19 Reasons Your Mortgage Loan Could Get Rejected Gobankingrates

Mortgage Denial Stats By Race What We Can Learn Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Why Do Underwriters Deny Mortgage Loans Forbes Advisor

Bulletin Daily Paper 2 9 13 By Western Communications Inc Issuu

Reasons Your Mortgage Can Get Declined In Underwriting 15 Youtube

Why The Underwriter Denied Your Mortgage Loan Mortgages And Advice U S News

19 Reasons Your Mortgage Loan Could Get Rejected Gobankingrates

19 Reasons Your Mortgage Loan Could Get Rejected Gobankingrates

19 Reasons Your Mortgage Loan Could Get Rejected Gobankingrates

Top Reasons Underwriters Deny Mortgage Loans Quicken Loans